Why we’re anti bad debt

My values have always been family and people first. That’s been a core driver for me personally and professionally. When I started building YouPay, I kept that as a core part of our DNA. We don’t want to make decisions or build products that could drag people down or harm their financial future. The fact is, Buy Now, Pay Later debt products aren’t a harmless, fun way to shop. A missed payment installment now doesn’t seem like a big deal, but it could count against your credit score, or even hurt your chances to buy a house. That seems like a rough deal for a pair of sneakers.

Look. As a Dad and a consumer, working to manage my own finances and take care of my family, I’m not immune to Buy Now, Pay Later products. I’ve used them before, I’ve used them sparingly, and I understand their appeal.

I’m not asking for them to be shut down. I’m not trying to start a mob.

But at the same time, I want there to be a choice. I want consumers to have the information about what they’re getting into, and to be able to use that information to choose alternative financial products that won’t come back to bite them down the track. From a business perspective, I see an opportunity for there to be an Option B and C, and I’m very eager for customers to have that power.

Buy Now, Pay Later is a credit card.

Let’s not kid ourselves. It’s a credit card. It works in almost exactly the same way.

Buy Now, Pay Later products have done well in their messaging; they have had massive success in marketing their tools as a more intelligent way of managing debt, to the point that many younger consumers don’t even realise debt is coming into it.

Don’t get me wrong; Buy Now, Pay Later is a better alternative to the old fashioned credit card with 55 days interest free and then a 17% interest rate, which is a terrible and harmful product. But at the same time, it is still debt. It’s still borrowing money. It shouldn’t be the first and only option available when you need an external form of funding, because you can find yourself falling into debt before you even realise it.

The point of Buy Now, Pay Later is to push you to spend money you don’t have.

The data is pretty clear. People tend to buy more than they need, and buy things they wouldn’t otherwise have spent money on, because Buy Now, Pay Later makes it easier, makes it feel less painful, and streamlines the process. The thing is, there’s no accountability. It’s delaying the feeling of spending, so you don’t get the feedback loop of your own conscious buying habits.

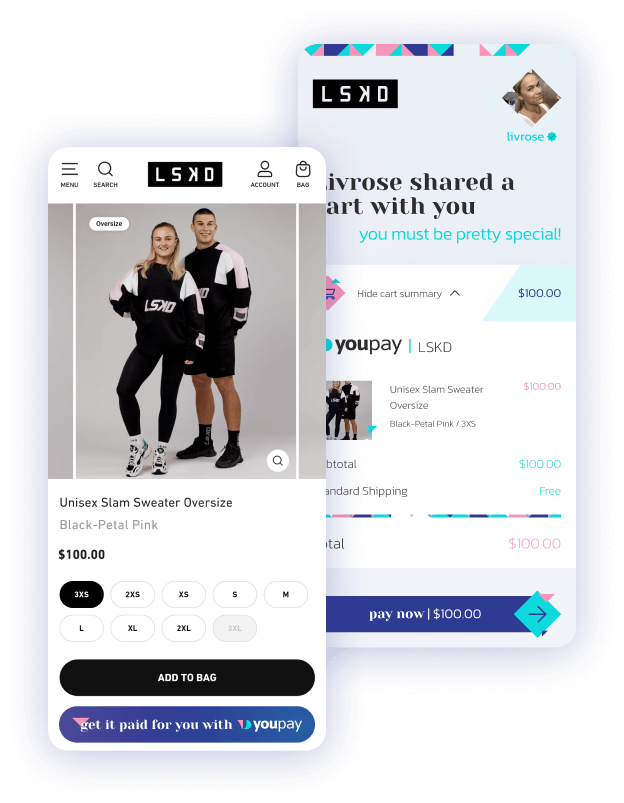

Afterpay is never going to stop you in your tracks and say, do you really need those shoes? Whereas a friend would pull you up and point out that you might be able to live without the six pairs of shoes you bought this month. That’s a really compelling feature of social and multiplayer shopping, where you can get that feedback from your support network, instead of simply being enabled by your payment options.

Debt products that don’t look like debt products build bad habits.

These products aren’t available to people under the age of 18, but with the marketing budget behind them, with the social pressure that these platforms can bring. Shoppers are holding out for the big day when they can finally go out at 18 and celebrate by having a drink, maybe even a gamble; and now we can add signing up for an AfterPay account to that list. And all of those things build habits that can last a lifetime.

People’s inability to control their spending is without a doubt a massive issue in society. And it starts at 18. It starts when young people are barely old enough to call themselves adults, when they’re still quite vulnerable and inexperienced. If you’re enabling small little incremental steps down that path to debt, there’s no way it couldn’t be seen as a negative. When you’re looking at a long road back from debt, the small Buy Now, Pay Later debts that got you there seem a lot more significant.

It comes down to the awareness of the habits you’re building. It seems harmless to buy a meal on a Buy Now, Pay Later app. But if you can’t afford to get a burger without getting into debt, the truth is – you can’t afford to get a burger. That’s the habit we need to break, but it’s the habit the platforms want to ingrain.

It’s about Choice.

Buy Now, Pay Later isn’t the devil. I know I can get a bit dramatic, but really – it’s about choice. People should have options that let them make the right call with their own finances, and build the right habits that will set them up for life. I want shoppers to be able to walk away from debt products – whether it’s a credit card or Buy Now, Pay Later – and to have the opportunity to be able to have someone else in their support network fund certain purchases.credit card.